City vs Country: How Your ZIP Code Changes Everything

Your ZIP code might as well be a secret code for how much you'll pay in car insurance, seriously. Move 20 miles out of the city and watch your premium drop like magic. Insurers crunch data on traffic jams, theft rates, even pothole counts in your area, all to price the "risk" of you filing a claim. Urban spots like Los Angeles or Miami? Nightmare for rates. Rural? Basically a discount code.

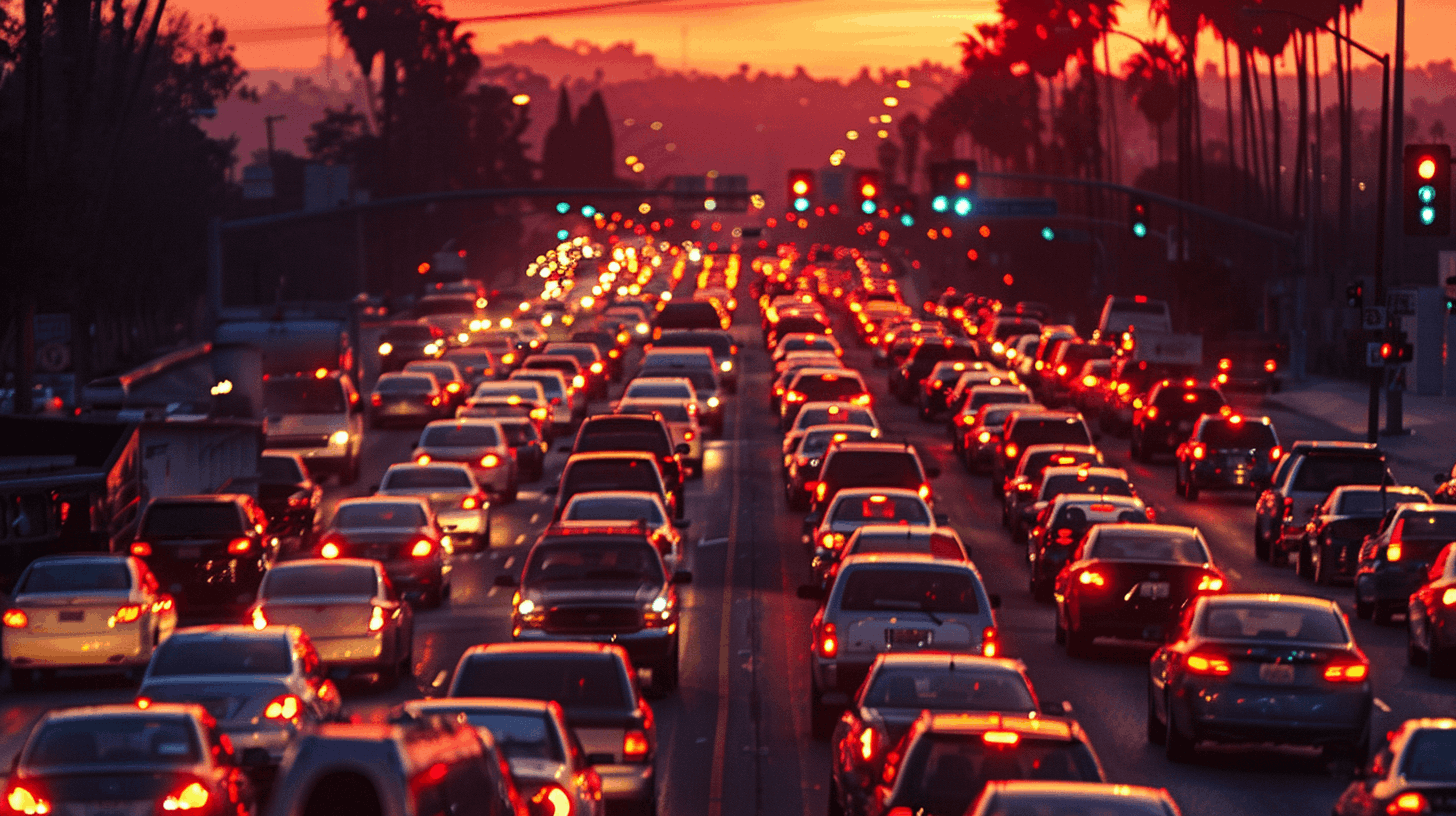

Take Los Angeles for starters. Full coverage there averages around $3,200 a year, or $267 a month, thanks to gridlock on the 405 that turns every commute into bumper-car roulette. Theft's rampant too, with over 20,000 cars swiped yearly in LA County alone. Compare that to a quiet suburb like Camarillo (ZIP 93012), where the same driver pays closer to $1,800 annually, half the price. Less cars zipping around means fewer fender benders, and cops actually respond to break-ins.

Miami's no better, clocking in at about $3,500 yearly for full coverage, $292 monthly. Hurricane season amps up the comprehensive costs, plus insane traffic in South Beach and high uninsured driver rates (over 20% in Florida). Swap that for a small town like Valdosta, Georgia? Drops to $2,000 or less, because who needs to worry about joyrides when your neighbor's got a shotgun on the porch.

Nationwide, urban vs rural gap runs 30-50% higher in cities. Why? More accidents per mile (urban fatal crashes are twice rural ones per the IIHS), pricier repairs in spots with union shops, and yeah, that flood of lawsuits from jammed highways. Rural folks deal with deer or icy roads, but claims are rarer and cheaper overall.

Now zoom out to states, because some are just cursed. Based on fresh 2025 data from spots like Bankrate and Forbes, heres the worst offenders for full coverage averages:

Louisiana leads the pack at $3,718 a year, Florida's right behind at $3,500-ish (hurricanes and no-fault laws kill ya), then New York $3,200 with its tolls and taxis everywhere. Michigan $3,000, California $2,900, Nevada $3,439 (Vegas chaos), Connecticut $2,800, Texas $2,700, Georgia $2,500, and Missouri $2,400 round out the top pain.

Flip side, the cheap thrills: Maine's a steal at $1,243 annually, Vermont $1,504, Idaho $1,443, New Hampshire $1,600, Ohio $1,700, Wisconsin $1,650, North Carolina $1,800 (liability's dirt cheap there), Wyoming $1,900, Iowa $1,850, and Minnesota $1,950. These are mostly quiet, low-pop states with good roads and folks who actually follow speed limits.

Buddy of mine ditched Miami for a farm town upstate last year, his bill fell from $4,200 to $2,100 overnight. Same truck, same record, just no more dodging tourists on Ocean Drive.

Truth is, your address calls more shots than your age sometimes. If youre stuck in a hot zone, bundle policies or hunt discounts like crazy. Otherwise, thank your lucky rural stars and keep it that way. Drive easy, wherever your ZIP lands you.